Happy Friday everyone!

As we head into thanksgiving weekend, we’re giving thanks we held Bitcoin and not any of the treasury stocks that have been tanking over the last few weeks (more on that later).

As is tradition, we’re covering the funniest moments in Bitcoin this week. While there’s no live stream this Friday we are still doing our giveaway (entry link below).

Lets get cracking!

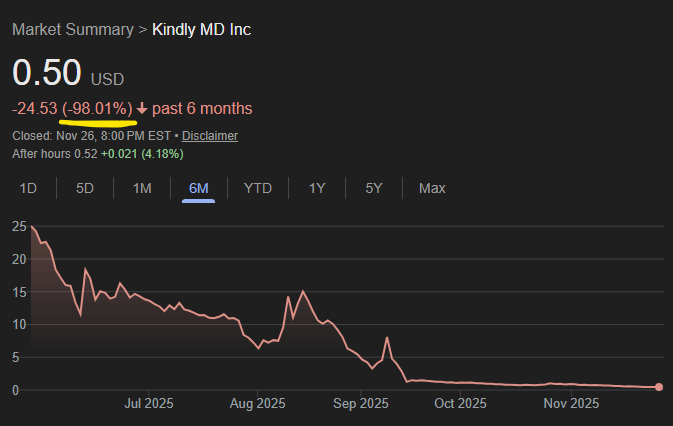

$NAKA Trades Like A Sh*tcoin

Nakamoto Holdings ($NAKA), David Bailey's Bitcoin treasury company, is now down 98% from its May high of $34.77 to around 50c today. The company holds over 5,700 Bitcoin worth more than half a billion dollars, but the stock market values the entire company at less than $300 million.

That means the market is pricing Bailey's leadership at negative value. Shareholders would literally be better off if the company just liquidated and distributed the Bitcoin.

The destruction came from PIPE deals (private placements) where insiders bought shares at $1.12 while retail investors were paying $28+ on opening day in May. When those PIPE shares unlocked in September, the selling was apocalyptic.

Bailey's response? He told shareholders who were upset to "exit" and claimed he was "upgrading the shareholder base" i.e. if you were taken advantage of by poor leadership decisions, that’s on you.

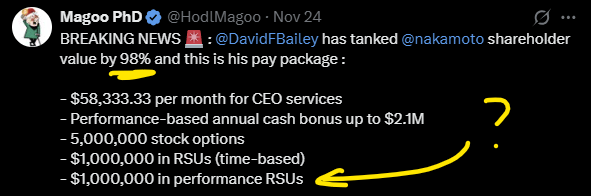

Not only was it poor leadership, but they also managed to give themselves excessive compensation in order to do so (talk about misaligned incentives…).

Bailey is set to receive a $306 million all-stock deal for his private company BTC Inc. based on a 10x EBITDA multiple that was negotiated when NAKA shares were flying high. Now the stock is a penny stock but Bailey still gets paid.

Multiple people on X have pointed out that NAKA holders have lost 98% yet nobody has pushed for a shareholder vote to suspend executive pay (not sure how he’s justifying his $1M in “performance” for his RSU’s 🤣).

OUR TAKE

Bitcoin treasury companies are getting crushed right now, and NAKA is exhibit A for why "levered Bitcoin exposure" is a trap. Just buy Bitcoin. Hold your own keys.

Don't pay executives to gamble with your money while they get rich regardless of performance. These companies are built to enrich management, not shareholders.

STRC Trades Back to Par

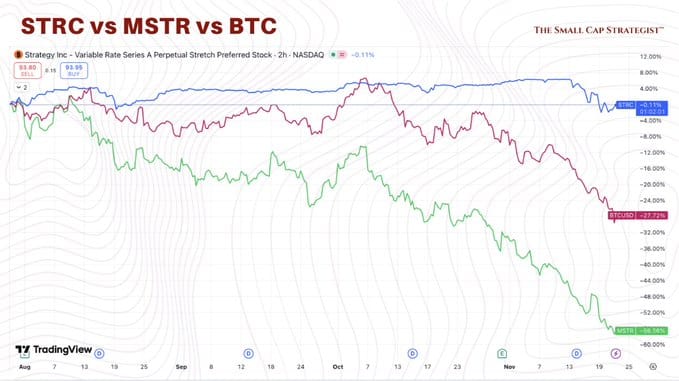

Michael Saylor's Strategy (MSTR) has been on a wild ride, and this week their convertible preferred shares (STRC) finally recovered back near their peg after trading at a nasty discount earlier this year.

Bulls are celebrating. "See? The model works!" Not so fast.

STRC is what happens when you take Bitcoin's volatility, wrap it in convertible debt, and pretend you've created a "safe" income instrument. Except there's no free lunch here.

Strategy has to constantly issue new shares to service their debt and buy more Bitcoin. Every time they do that, existing shareholders get diluted. So you're not actually getting yield, you're getting paid with your own equity getting watered down.

The STRC trade only works if Bitcoin goes up forever in a straight line. If Bitcoin corrects, the whole structure gets squeezed and STRC holders watch their "safe" investment crater below par.

We saw it earlier this year when Bitcoin pulled back and STRC traded at a double-digit discount. Now Bitcoin is back up and STRC recovered. Cool. But that's not a feature, that's just Bitcoin being Bitcoin.

OUR TAKE

STRC might work for sophisticated traders who understand the risk, but for 99% of people reading this, it's a bad trade. You're taking on Saylor execution risk, convertible debt mechanics you probably don't fully understand, and dilution risk.

Just buy Bitcoin. Hold your own UTXOs. Stop trying to get cute with financial engineering.

Want a Heads Up When We Go Live? 👇

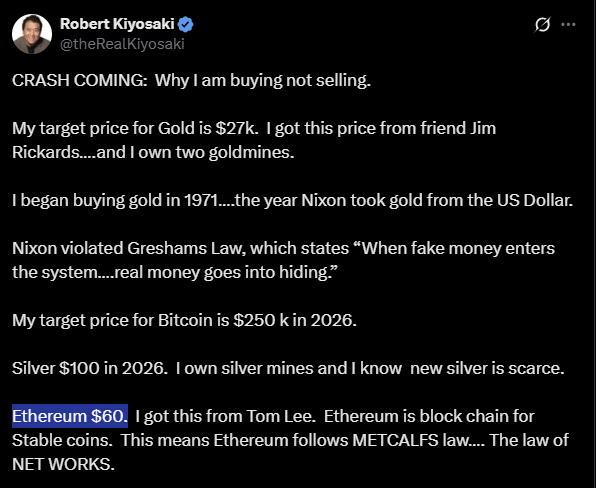

Kiyosaki Calls for $60 ETH

Robert Kiyosaki dropped what might be the most confusing prediction of the year: "Ethereum $60. I got this from Tom Lee." Wait. Sixty dollars? As in, a 98%+ collapse from current prices?

Is Kiyosaki calling for Ethereum to essentially go to zero? Or did he mean $60,000 and forget three zeros? Honestly, with Kiyosaki's track record, both are equally plausible.

Here's what's actually happening: Kiyosaki is a professional engagement farmer. On October 22nd, he was calling for $60,000 Ethereum. Then Bitcoin corrected from $120k and suddenly Kiyosaki turns bearish? Convenient timing, buddy.

It's the classic move of predicting everything so you can claim you were right no matter what happens.

But wait, it gets better. Right after calling the Bitcoin top, Kiyosaki posted that he sold $2.25 million in Bitcoin (bought at $6,000) to buy surgery centers and a billboard business.

He's estimating $27,500 a month in cash flow by February "tax free." This is peak boomer energy: sell your Bitcoin at $90k to buy surgery centers. Seriously, what could go wrong?

OUR TAKE

Kiyosaki built a career on telling people to buy assets and avoid liabilities, which is sound advice. But watching him flip-flop between bull and bear depending on what gets the most retweets is exhausting.

If you're making investment decisions based on what Rich Dad tweets, you're already cooked. Do your own research and have conviction.

Referral Bonus 🤑

STACK MORE SATS💸

Love The Friday Stack? Refer 3 friends and earn another 21,000 sats. Simple as that.

Crypto Fails of the Week😄

TOP 3 FAILS

1st Place: Ethereum is a stablecoin (you’re still losing money every year to debasement though)

2nd Place: Coinbase disabling sells on newly launched altcoin (nothing to see here its all totally legit, right?)

3rd Place: “Delivery Man” steals $11M in crypto in wrench attack (link to video here)