Happy Friday everyone, Rob, Avi, and Jody here with the Friday Stack.

Another week, another round of altcoin holders discovering why Bitcoiners are the way they are.

ZCash ($ZEC) has been cut in half from its November high and holders are grateful nobody can see their losses.

MartyParty tried to call out Ben Cowen on moving averages and got ratioed into oblivion.

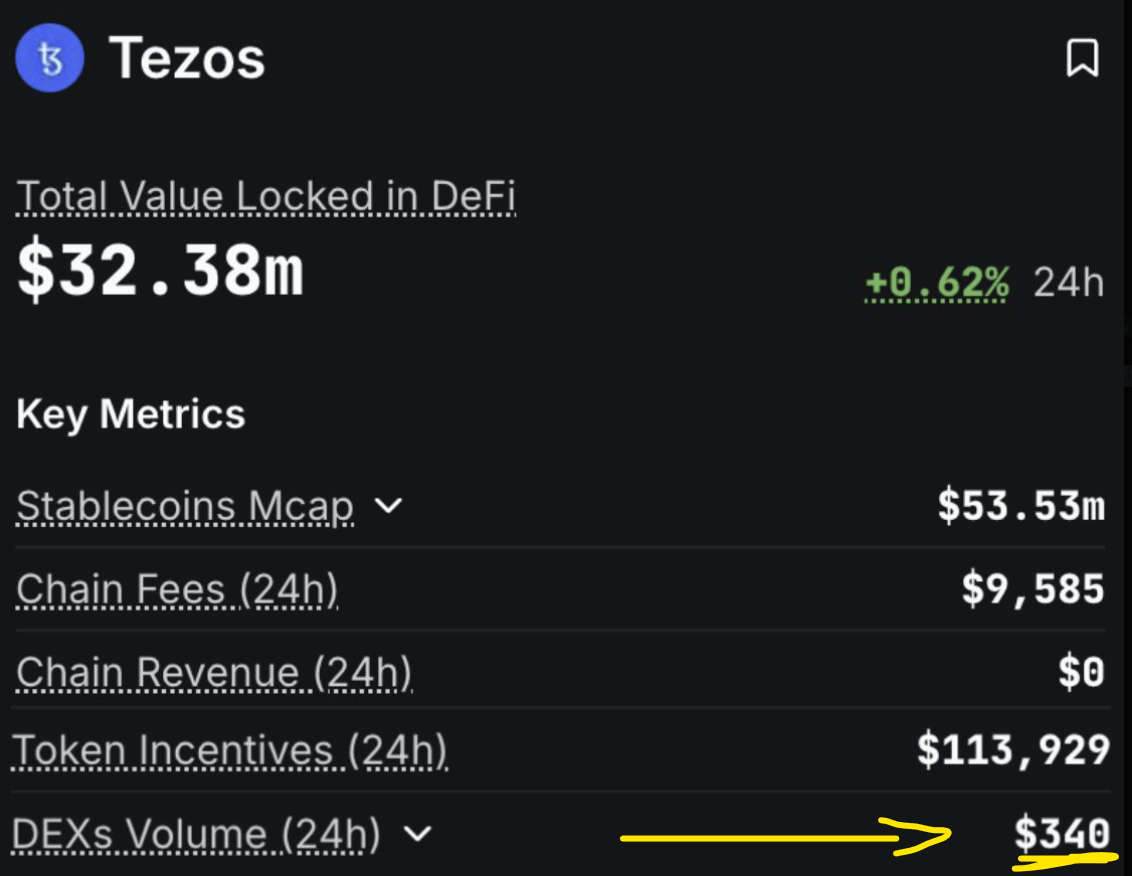

And Tezos, a chain that raised nearly 300 million dollars, is now doing $340 a day in DEX volume (no that’s not a typo).

THE FRIDAY STACK: MOUNT RUSHMORE

Which one would you trust with your last thousand bucks?

Join us LIVE at 12:30 PM ET as we rank the Bitcoin treasury companies and debate which ones are worth your sats.

Ping me when you go live?

Franklin Bought ZCash

Remember when ZCash pumped over tenfold earlier this year? Good times for the long time bagholders.

The privacy coin has since cratered nearly 40% from its November high. Canary Capital's CEO Steven McClurg publicly labeled it a "pump and dump" that got "rug-pulled". His words, not ours. He said he initially bought into the narrative, then changed his view after digging deeper.

But the real comedy came from crypto Twitter. Alex Svanevik summed it up perfectly:

"So glad no-one can see how much I've lost on zcash... thank god for privacy".

One reply nailed it harder: "Finally found a real-world use case for privacy coins: hiding the shame".

Source: @BitPaine

Meanwhile, one trader took a 7 figure leveraged long position on ZCash just nine days before the crash. He's sitting on a 4 figure loss (seems like privacy can’t hide everyone’s losses).

OUR TAKE

Turns out the real use case for privacy coins in 2025 is hiding your losses. When your coin's top endorsement is "at least nobody can see how much I lost" maybe it's time to rethink your thesis.

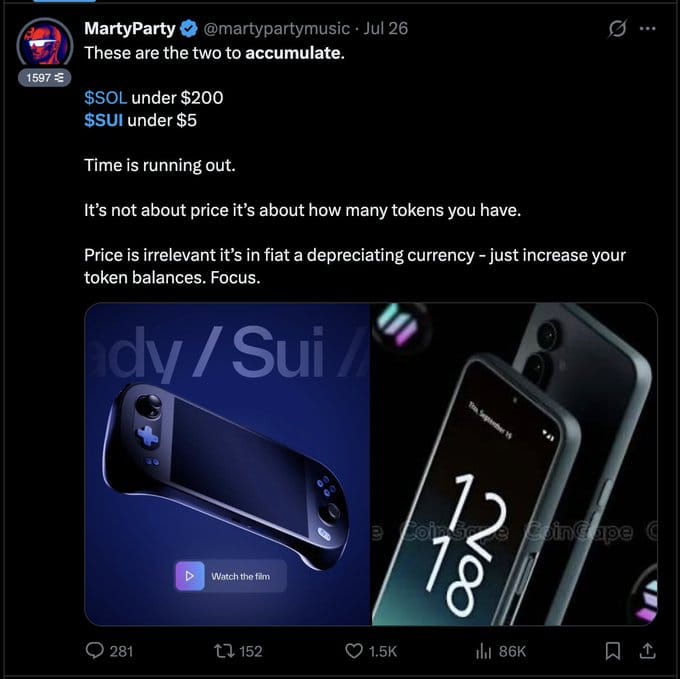

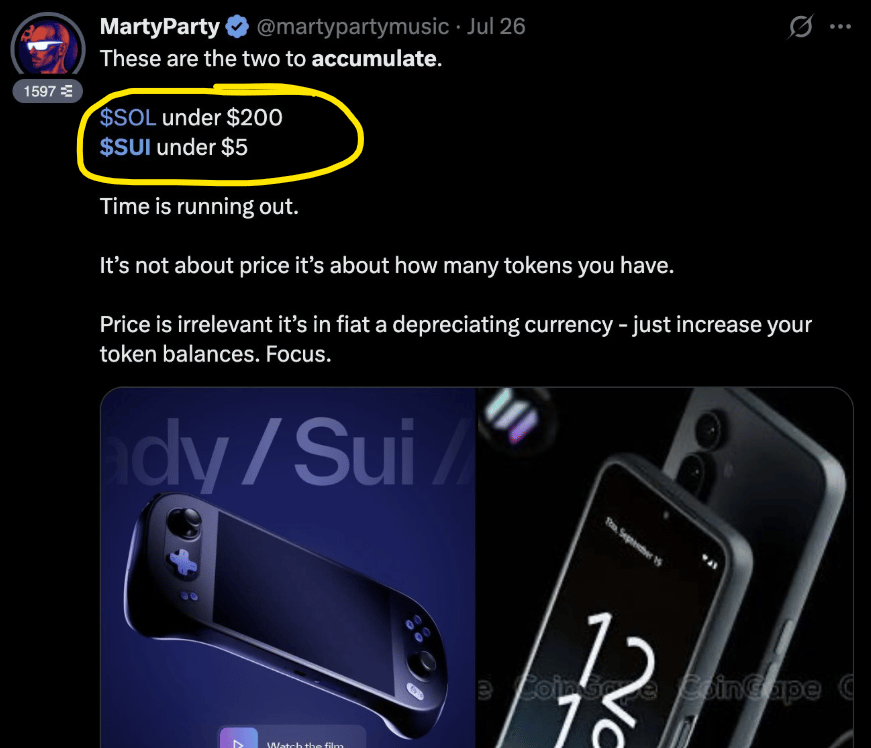

MartyParty’s DCA Advice Aged Like Sour Milk

Crypto influencer MartyParty posted that Bitcoin "breaks through the 200 day moving average on the 4hr" and declared that Ben Cowen (@intocryptoverse) "was wrong".

But in reality, that's not how moving averages work.

Ben responded with a brutal correction: "When you change to the 4 hour timeframe and look at the 200 period moving average, you are actually showing the 33.33 day moving average. Calling it to the 200 day moving average is completely nonsensical. I suggest you understand some basic math".

Source: @MartyPartyMusic

The ratio was swift. Nearly 4,000 likes on Ben's response. Then another user piled on, digging up MartyParty's July tweet telling people to "accumulate" SOL under two hundred and SUI under five bucks.

"Time is running out" he said back then. Both have since cratered.

OUR TAKE

When an influencer says "time is running out" what's actually running out is their patience waiting for exit liquidity. That's you, by the way. Maybe learn how moving averages work before challenging analysts with actual credentials.

Tezos: Quarter Billion Raised, $340 Daily Volume

This one speaks for itself.

Tezos raised a quarter billion in one of the largest ICOs ever. Their current daily DEX volume? Three hundred forty bucks. Their 24-hour on-chain revenue? Literally zero. Not "close to zero." Actually zero (well, at least according to DefiLLama).

But somehow the token still trades at a half-billion valuation (wait… what?). What's keeping it alive?

F1 and football sponsorships funded by endless token inflation. As one Twitter user put it: "Their real activity is handing out F1 and football sponsorships funded by endless inflation. There's no reason for it to exist".

That's not a blockchain. That's an ad budget with a whitepaper.

OUR TAKE

Same energy as Luna Classic tripling this month while still sitting at the absolute floor from its collapse. People don't learn. And that's why we do this every Friday (to remind you why Bitcoin > Crypto).

That's it for this week.

Tune in at 12:30 ET to enjoy more Bitcoin entertainment and some Sats live on our show.

Rob, Avi & Jody

P.S. Reward tiers scale up to 1,000,000 Sats.