Happy Friday everyone, Rob, Avi, and Jody here with the Friday Stack.

While crypto holders watched their "diversified sh*tcoin portfolios" bleed out, one solo Bitcoin miner just turned pocket change into $271,000.

No Discord trading groups.

No fancy tokenomics or token buybacks.

Just proof of work.

Let’s get into this weeks crypto fails.

THE FRIDAY STACK: MOUNT RUSHMORE

Join us LIVE at 12:30 PM ET with Lucas Martín Calderón, co-founder of Kash, as we dive into twitter prediction markets (and a chance to grab some sats).

Ping me when you go live?

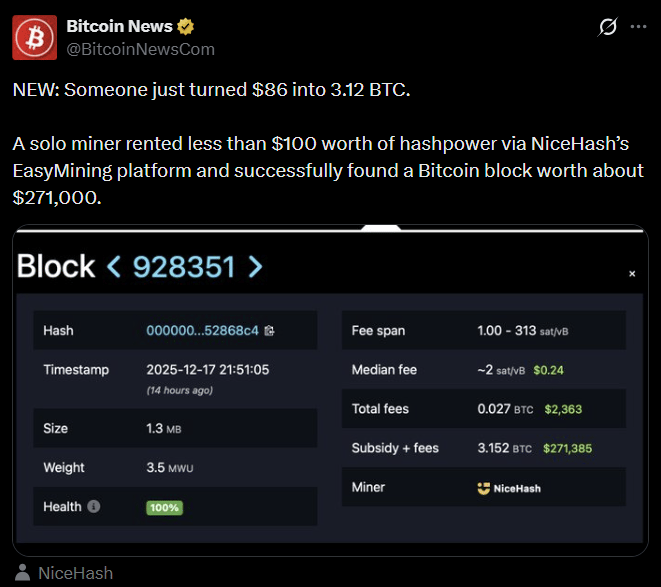

Solo Miner Turns $86 Into $271,000

While altcoin gamblers were losing funds chasing "alt season" a solo Bitcoin miner hit the actual jackpot.

On December 17th, an anonymous miner rented less than $100 worth of hashpower through NiceHash's EasyMining platform. Total cost: around $86.

They found Bitcoin block 928,351 and collected the full reward: 3.152 BTC worth approximately $271,000.

The odds? Astronomical. The network hashrate sits above 700 EH/s. This miner was competing against industrial operations and public Bitcoin miners with millions in hardware.

And the solo miner won.

This isn't the first time this year either. In November, a solo miner with just six terahashes mined a block worth over $264,000. The odds on that one? Roughly one in 180 million.

OUR TAKE

Everyone's chasing "alt season" hoping their bags will pump. Meanwhile the real lottery is on the Bitcoin network. No VC unlocks. No team dumps. No rug pulls. Just math and proof of work (oh, and a lot of luck).

NAKA Gets the Nasdaq Warning

Remember $NAKA? David Bailey's Bitcoin treasury company that was supposed to be the next big thing?

The stock is now trading around $0.38. Down ninety eight percent from its May high of nearly $35. This week, Nasdaq sent them a formal delisting warning for failing to maintain the $1 minimum share price (lol).

They have 180 days to fix it. If the stock doesn't close above $1 for ten consecutive trading days by June, they're off the exchange.

The irony? NAKA still holds over 5,300 Bitcoin worth roughly $466 million. But the company trades at a market cap of around $256 million. The market is once again pricing Bailey's leadership at hugely negative valuation.

Bailey's response to frustrated shareholders? He told them to "exit" and claimed he was "upgrading the shareholder base".

OUR TAKE

NAKA shareholders could liquidate the company, distribute the Bitcoin, and come out ahead. Instead they're watching executives collect fat compensation while the stock trades like a penny stock.

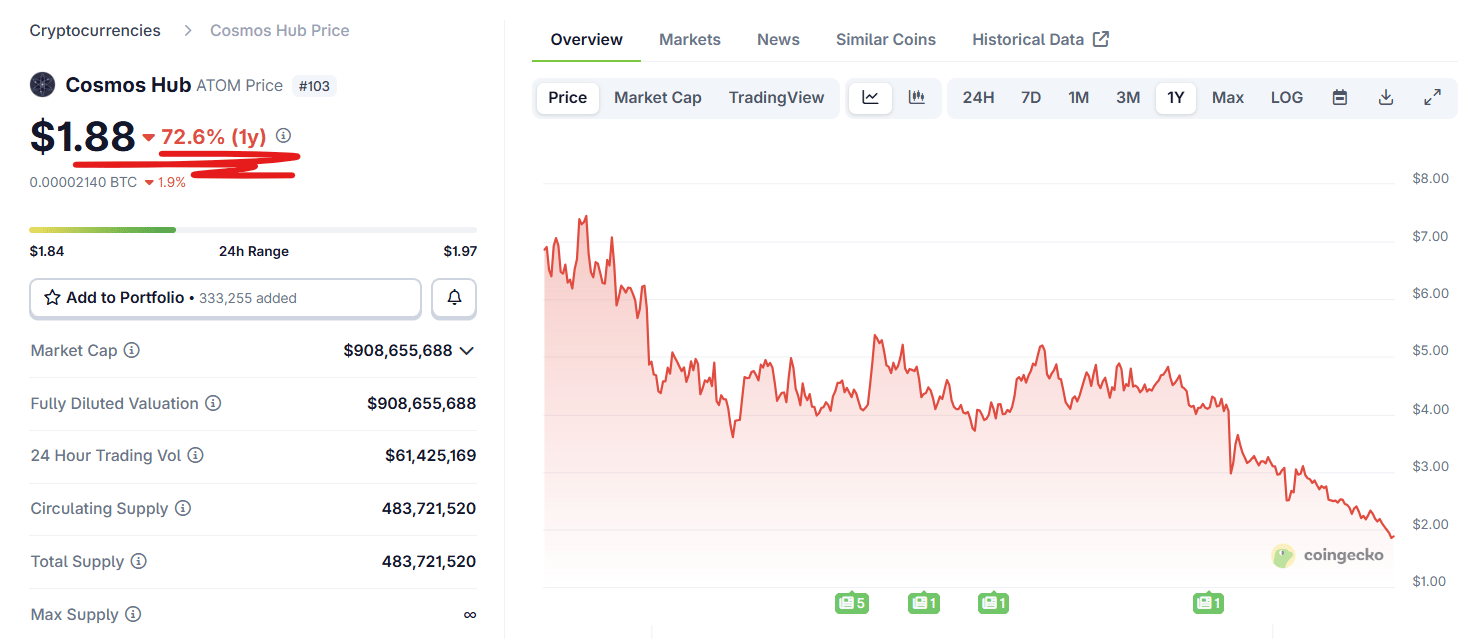

Cosmos Ecosystem: Mass Extinction Event

The "Internet of Blockchains" is looking more like the Internet of Shutdowns.

This year, multiple major Cosmos projects called it quits: Comdex, Kujira, Evmos, Picasso, Quasar, and Stride (if you haven’t heard of them, congrats for not being down 100%).

They covered DEXs, DeFi, NFTs, lending, and liquid staking (all the typical sh*tcoin buzzwords). The entire backbone of what was supposed to be a thriving ecosystem.

The reasons? Lack of growth. No revenue. Developer exodus (who could have seen that coming).

ATOM has cratered over ninety percent from its 2021 peak of $44 to around $2 today. Osmosis down seventy nine percent. JUNO collapsed eighty two percent to near zero.

Back in 2022, Cosmos ranked second in total value locked. Now it's a graveyard.

OUR TAKE

The Cosmos ecosystem raised hundreds of millions to build the "blockchain of blockchains". What they got was a bunch of chains nobody uses and tokens nobody wants. Meanwhile Bitcoin keeps doing its thing: one chain, one asset, still works.

That's it for this week.

Tune in at 12:30 ET to enjoy more Bitcoin entertainment and some Sats live on our show.

Rob, Avi & Jody

P.S. Reward tiers scale up to 1,000,000 Sats.