Happy Friday everyone, its Rob, Avi, and Jody with your Friday Stack.

Looks like it's that time of year again where everyone freaks out over a Bitcoin drawdown (like it isn't completely normal during a bull market).

Bitcoin dipped and everyone's acting like it's 2022 again. It's not.

Meanwhile, another treasury stock is imploding (shocker), the NYT just exposed David Sacks' conflicts of interest, and every crypto heavyweight rushed to defend him within hours. Nothing suspicious there.

At 12:30 PM ET we're breaking it down live on The Friday Stack. Plus Katie the Russian is joining us to debate which countries we'd flee to and talk second passports.

THE FRIDAY STACK: MOUNT RUSHMORE

Which country would you flee to?

Ping me when you go live?

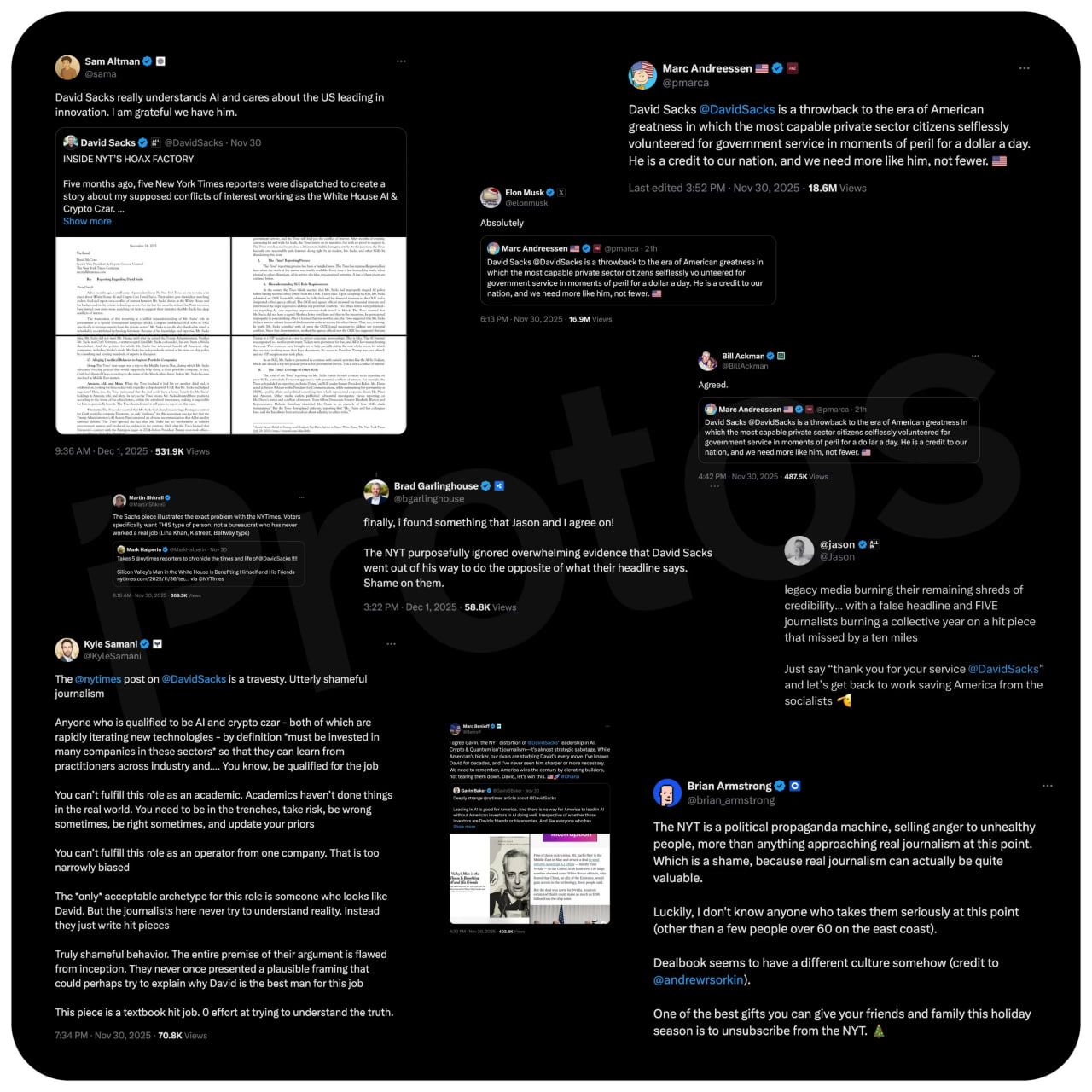

David Sacks’ Cultists Rush to his Aid

The NYT dropped a bomb this weekend: "Silicon Valley's Man in the White House Is Benefiting Himself and His Friends".

The article details how David Sacks, Trump's AI and crypto czar, has helped formulate policies that directly benefit his own investments and his Silicon Valley buddies. We're talking hundreds of illiquid investments that conflict with his government role. He's had nearly a year to divest. He hasn't.

The response from crypto Twitter? Predictable. Brad Garlinghouse, Marc Andreessen, Bill Ackman, Brian Armstrong, and dozens of other crypto heavyweights rushed to defend him within hours.

None of them actually disputed the facts in the article. Instead they called it a "hit piece," said Sacks is "selfless," and Brian Armstrong called the NYT "a political propaganda machine”. I mean look at the responses below… seems pretty coordinated to us.

OUR TAKE

Yet another example of “show me the incentive and I’ll show you the outcome”. The throng of people defending Sacks are the very same people who benefit from his policies. Many of them have received direct funding from Sacks or his VC firm Craft Ventures. It's not a conspiracy, it's just incentives doing what incentives do.

Pity your stock is in the toilet

Remember when we said Bitcoin treasury stocks were a trap? Well, this is exhibit B.

$BRR (Columbus Circle Capital Corp I), the SPAC merging with Anthony Pompliano's ProCap BTC, just tanked nearly half its value in the last month. The stock went from around ten bucks to under six as of this writing. Trading was even halted on November 28th due to volatility.

Sound familiar? It should. This is NAKA again. Different ticker, same playbook. Retail gets excited about "leveraged Bitcoin exposure," insiders grab favorable entry points, and when the music stops, guess who's left holding the bag?

OUR TAKE

The treasury company model has a fundamental flaw: you're paying management fees and taking on execution risk for something you could just do yourself by buying Bitcoin. Also, no offense to Pomp (he's done a lot for Bitcoin education) but his track record is questionable at best - remember Blockfi?

What's the funniest crypto fail you saw this week?

Hit reply with your answer - we'll feature our favorite next Friday (and send you some sats).

Chill Out (This Ain’t a Bear Market)

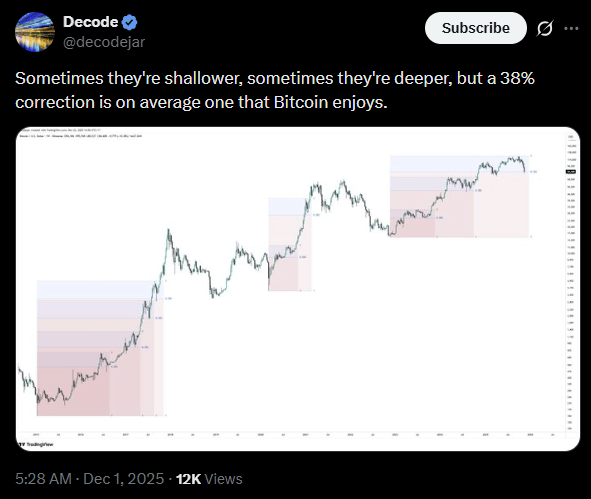

Bitcoin pulled back from $ 100k+ and Twitter is acting like the sky is falling. Let's just take a breath.

This is what Bitcoin does. It runs, it consolidates, it shakes out weak hands, and then it runs again. We've seen this movie before.

The macro setup hasn't changed: ETF inflows are still happening (they reversed for the first time in weeks) and corporate treasuries are still accumulating, albeit at a slower pace.

@Decodejar's chart below this week puts it perfectly in perspective. We're not crashing, we're consolidating. There's a difference.

If you've been in Bitcoin for more than one cycle, you know the drill. If this is your first rodeo, welcome to volatility. It's a feature, not a bug.

OUR TAKE

Pullbacks like this shake out the tourists and reward the patient. If you've been stacking consistently, this is just noise. The macro case for Bitcoin as a long term store of value hasn't changed (it’s just the short term headlines that have).

That’s it for this week guys.

Tune in @ 12:30 ET this Friday to enjoy more Bitcoin entertainment and grab some Sats live on our show (reply “Bitcoin” to this email to 2x your chances).

Rob, Avi & Jody

P.S. Reward tiers scale up to 1,000,000 Sats.